The Price of Everything and the Value of Nothing

Written By: Franklin Obeng-Odoom

Date: 2021-11-28

Views: 4604

Source:

Economics is caught in multiple crises. Economists seem to know more and more about what is less and less important and less and less about what is more and more important. The price of everything is known, but less is known about the value of things. Consider the debates on pricing theory and market structures.

Debates on pricing theory and market structures

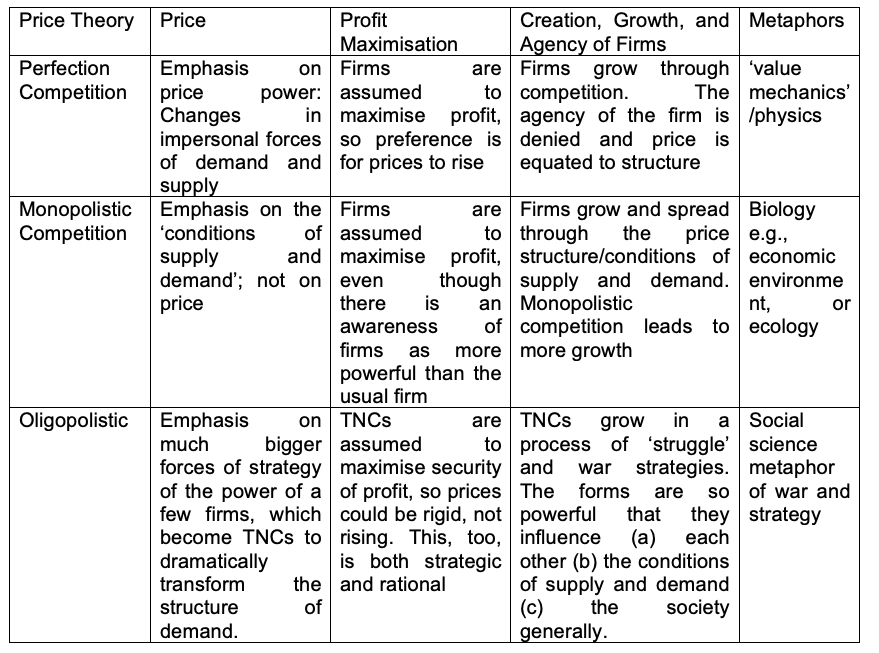

In 1947, K.W. Rothschild wrote a seminal paper on ‘Price Theory and Oligopoly’ in which he showed that at the heart of price theory are debates about monopoly. At the time of his intervention, Rothschild argued that price theory had gone through two phases. As shown in Table 1, these were perfect competition and monopolistic competition.

Table 1: Price Theory, From Physics to Social Science

Source: Rothschild

Each of these phases could be distinguished by how price was determined and whether profit maximisation was the goal of business. Accordingly, the creation, growth, and the agency of firms could be another criterion for making a distinction between diverse theories of price. Because metaphors are so central to the making of economics, a point about which Philip Mirowski has written an entire book, Rothschild took the view that price theory could also be distinguished based on the choice of metaphors.

Rothschild contended that the shift from perfect competition to monopolistic competition was necessary, but it was not sufficient to explain the pricing structure of ‘real-world’ markets. Transnational corporations (TNCs) were not constrained by so-called conditions of supply and demand. TNCs created and recreated those conditions. The form of TNCs also defied the prevailing theory of how firms formed and changed. TNCs were giants. They controlled both the business environment and the price. TNCs could change the price, and the conditions of supply and demand. They exercised considerable power, prompting Rothschild to metaphorically describe their strategy as war. From this perspective, Milton Friedman was wrong. The aim of business is not profit maximisation, but rather ownership and control.

Rothschild considered three ways to address the problem of oligopoly theoretically. The first is to first acknowledge oligopoly but regard it as an exception. The second is to jettison perfect competition and claim that a theory of pricing is not possible at all. A third is to reject perfect competition and replace it with oligopoly and duopoly as the new pricing theory. Rothschild’s own preference was this third approach.

Georgist political economists may use both concepts (see, for example, Obeng-Odoom’s analysis here, especially pp. 192-194). When they do, they imply both an acceptance and a critique of price theory. On the one hand, Rothschild’s critique is founded, but on the other hand, it is limited to the neoclassical economic interpretation of monopoly. Georgist political economists take a different view. Yet, this approach is neither well known nor clearly understood.

Georgist Political Economy

In Georgist political economy (GPE), monopoly has a radically different meaning. As CW Cobb’s recent paper shows, on the one hand, ‘monopoly’ means what it meant in the progressive era: concentration, power, and privilege that created social problems such as tyranny of a few (see Justice Brandeiss’ and Smith’s views on pp. 1049, 1045 in Cobb’s article). On the other hand, monopoly was strongly linked to land concentration and private ownership of land. The total meaning of monopoly, however, is much grander than the sum of these two parts.

Neoclassical economists watered down this definition/conception and equated monopoly only to pricing, supply, and demand, to which arose debates about monopolistic competition and the new pricing theory of oligopoly (see Table 1). As Cobb shows, mainstream economists (e.g., George Stigler) claimed that the way to judge the problem of monopoly is to focus on either social harms, social welfare, or growth, and on all these, monopolistic competition (competition among a few TNCs) does the job of growing the economy, benefiting people, and causing the least harm, broadly. Some heterodox scholars have broadened the test: Schumpeter argued that we should ask whether monopolistic competition generates innovation.

However, for Georgists, the key question remains: the social problem of monopoly is not just about pricing. It is ‘knowing the price of everything and the value of nothing’, as Cobb correctly notes (see p. 1052). Reducing economic organisation to only pricing theory as argued by orthodox and heterodox economists (e.g., Rothschild) alike is a serious problem. Huge corporations, monopolistic landlords, and military or media cartels undermine the foundations of social harmony, progress, and justice. ‘Rent’, Henry George wrote in Progress and Poverty (see p.167), ‘in short, is the price of monopoly’. This curse emanates ‘from the reduction to individual ownership of natural elements which human exertion can neither produce nor increase’ (p.167).

Rethinking Economics

Clearly, one area in need of rethinking economics is economic concepts. They must be read and understood in context. The debates about price theory, monopoly, and oligopoly illustrate the point. In the light of the evidence about The Corruption of Economics, it can be argued that the narrowing of the concept of monopoly persists, not in spite of the interventions by K.W. Rothschild and Georgist political economists, but precisely because of such attempts. The use and misuse of concepts are common, but such ‘mistakes’ are not innocent. Economic concepts are used for a purpose, in this sense, disguising the activities of special interests such as TNCs and landlords and linking them only to pricing. Returning the meaning of monopoly to the bigger path is needed to address the social problem of knowing the price of everything and the value of nothing.

----

Franklin Obeng-Odoom is the Helsinki Institute of Sustainability Science Associate Professor at Global Development Studies, the University of Helsinki, Finland. He is the editor-in-chief of the African Review of Economics and Finance. He can be contacted via franklin.obeng-odoom@helsinki.fi

Acknowledgements

Many thanks to Odile Mackett for helpful feedback on an earlier draft.